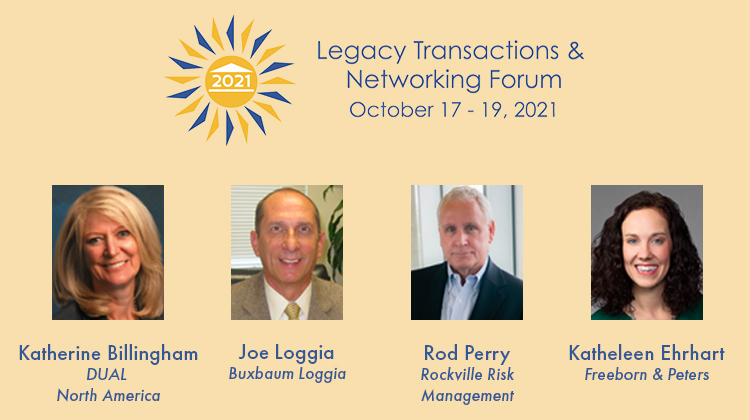

The panelists for this insightful session on the relationships between insurers and the agents they work with included Katherine Billingham, General Counsel, DUAL North America, Joe Loggia, Vice President, Buxbaum Loggia, and Rod Perry, Senior Vice President, Rockville Risk Management with Katheleen Ehrhart, Partner at Freeborn & Peters serving as panel chair.

MGA/TPA relationships, involve managing general agents (“MGAs”) or third party administrators (“TPAs”) entering into binding authority agreements with issuing carriers that allow them to bind business (MGAs) or handle and settle claims (TPAs) on behalf of the carriers.

The interests and goals of each party entering relationships are diverse. On the underwriting side, the carrier may want to write program business that requires expertise offered by agents specializing in the niche business; or may consider certain business is better suited to being underwritten by an MGA with access to the distribution channels from retail and wholesale producers.

On the claims side, MGAs may offer in-house claims handling services; however, such arrangements are getting scarcer due to, among other reasons, adverse loss experience, profit commissions and conflict of interest arising from an underwriting agency handling its own claims.

The focus of contracting agreements is to view the arrangement from a business perspective. When designing a contract with a TPA, the aim is to secure all expectations and avoid triggering E&O coverage. To complicate matters, the TPA’s E&O coverage may not cover the entirety of the carrier’s lost funds. It pays to understand the billing arrangements and to ensure the TPA is set up to remit funds and information upfront. The carrier must set up its key performance indictors and communicate expectations and goals to the TPA for it to manage personnel accordingly. Some legacy claims and financial systems are sub-standard which present a challenge requiring the carrier to be forthright about its needs with the TPA. Annual audits are insufficient. Monthly meetings to discuss bordereaux and individual claim loss development are crucial and being aggressive in handling the legacy business with TPAs accomplishes the needed results. In contrast with having business handled in-house, the carrier must stay in control to maintain a healthy partnership with MGAs and TPAs to avoid future disputes.

The binding authority agreement with an MGA ought to address the parameters of the underwriting authority of the MGA. The scope of the authority may determine the oversight, which in all cases must be ongoing. If an audit reveals the contract terms were not met, the carrier may challenge the underwriting of a program or of a single policy. Questions will arise whether examination of the bordereaux would have revealed issues discovered during the audit but the carrier missed oversight of or did not address right away. If the MGA also handles claims for the carrier, did oversight encompass claims handling as well and were regular audits undertaken? If loss ratios deteriorate, the carrier should examine whether the adverse results emanated from underwriting or from claims handling.

Potential disputes between agents and carriers are inevitable and may arise from an allegation that an MGA breached the underwriting guidelines, failed to remit the correct premium, submit timely data analytics such as bordereaux and/or exercise proper control over the book of business. When investigating its contract with the MGA, the carrier should raise adverse developments forthwith to avoid estoppel issues. If the audit uncovers a vulnerability, follow up with the MGA to timely address adverse claim development because of the MGA’s/TPA’s misconduct is vital.

When entertaining acquisition of legacy business transactions with agency relationships, a carrier would benefit from staying in its area of expertise and focus enquires on whether the MGA understands its book of business. In due diligence, the key is to seek input from those who have the knowledge. COVID has presented the challenge of navigating virtual audits, where auditors are unable to obtain information one usually gets from sitting across from staff. If done correctly, reviewing claims files entails validating all the records and getting the requisite information. When reviewing an MGA, pay attention to whether the MGA handled the claims or outsourced it, examine the underwriting and handling of large losses, and whether the policy meets underwriting guidelines. Inspect the payment structure of the claims TPA, i.e., the motivation to handle the claims and its basis that may incentivize the TPA to pay a higher indemnity just to “get rid of” the claim.

During the due diligence exercise, it is advantageous to stay abreast of the marketplace on the live side.

After due diligence if the carrier decides to acquire the business, the carrier’s motivation for the acquisition should drive the structure of the transaction, i.e., is the end game to enter that market, to start writing that class of business, for investment purposes or to continue writing the business, control the portfolio and get to know the MGA writing the business.

After the acquisition, if problems develop, the carrier may take recourse such as analyzing the book to establish the extent of non-compliance; explore various business solutions; arbitrate the dispute; or negotiate a resolution.

The panel discussed the need to be aggressive in handling the exposures and to have a clear dialogue with the issuing carrier when handling the claims as a TPA if you find a deviation in the underwriting. All parties may be possible targets to pursue aggressively, be it the MGA, the TPA or the loss portfolio transfer contract and make every attempt to resolve issues early.

Many companies acquire legacy business to diversify portfolio with policies in effect for an indefinite period until a new market becomes available to write the business and/or to satisfy certain states that do not allow non-renewal of policies unless a new market can be found to write the business. If, In the meantime, underwriting deteriorates, then find another MGA to write the portfolio, or work with the MGA to rate the business based on the loss development by achieving appropriate rate increases.

Opportunities for deals exist in the workers compensation, passenger and commercial automobile, construction defect and medical malpractice lines of business.

When taking control of a legacy business, seek a strong reporting mechanism, as insufficient data can lead to great consternation. Stratify the exposure and focus on the option that may cause financial loss, and chances are it is the layer where there is no or inadequate reinsurance cover.